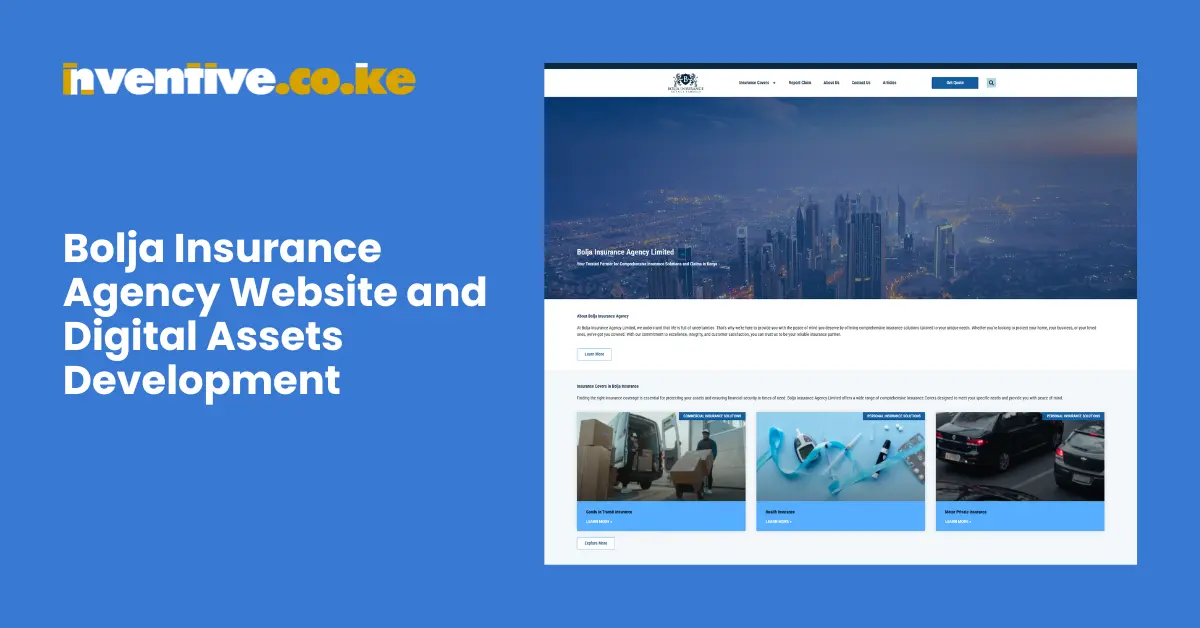

Bolja Insurance Agency Website and Digital Assets Development

Bolja Insurance Agency has embarked on a comprehensive digital transformation to bolster its online presence, engage with clients more effectively, and streamline its digital operations. This report covers the strategic development of their website, digital marketing assets, and other online tools designed to drive growth and improve client interaction.

Project Scope:

Website Development:

-

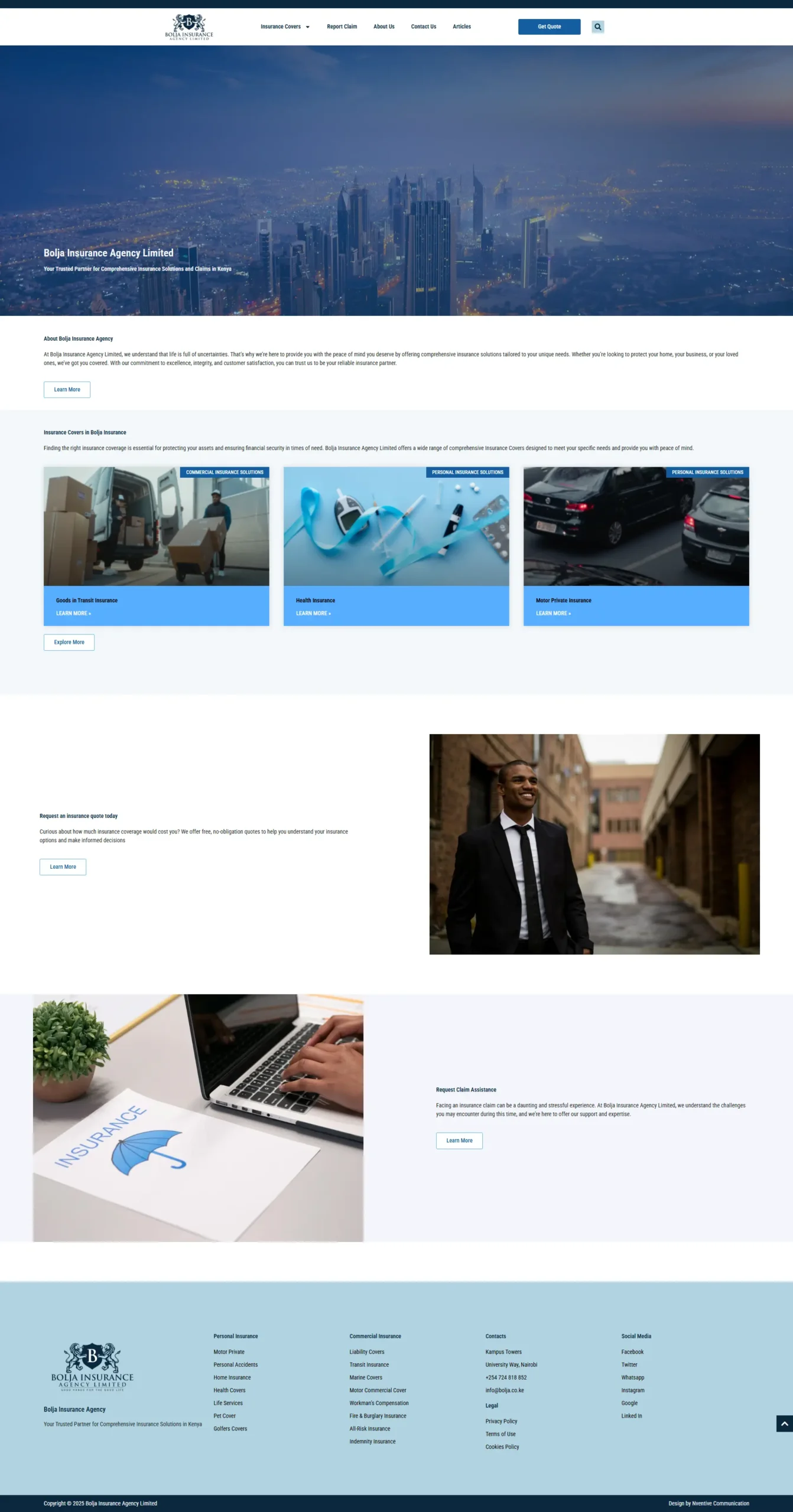

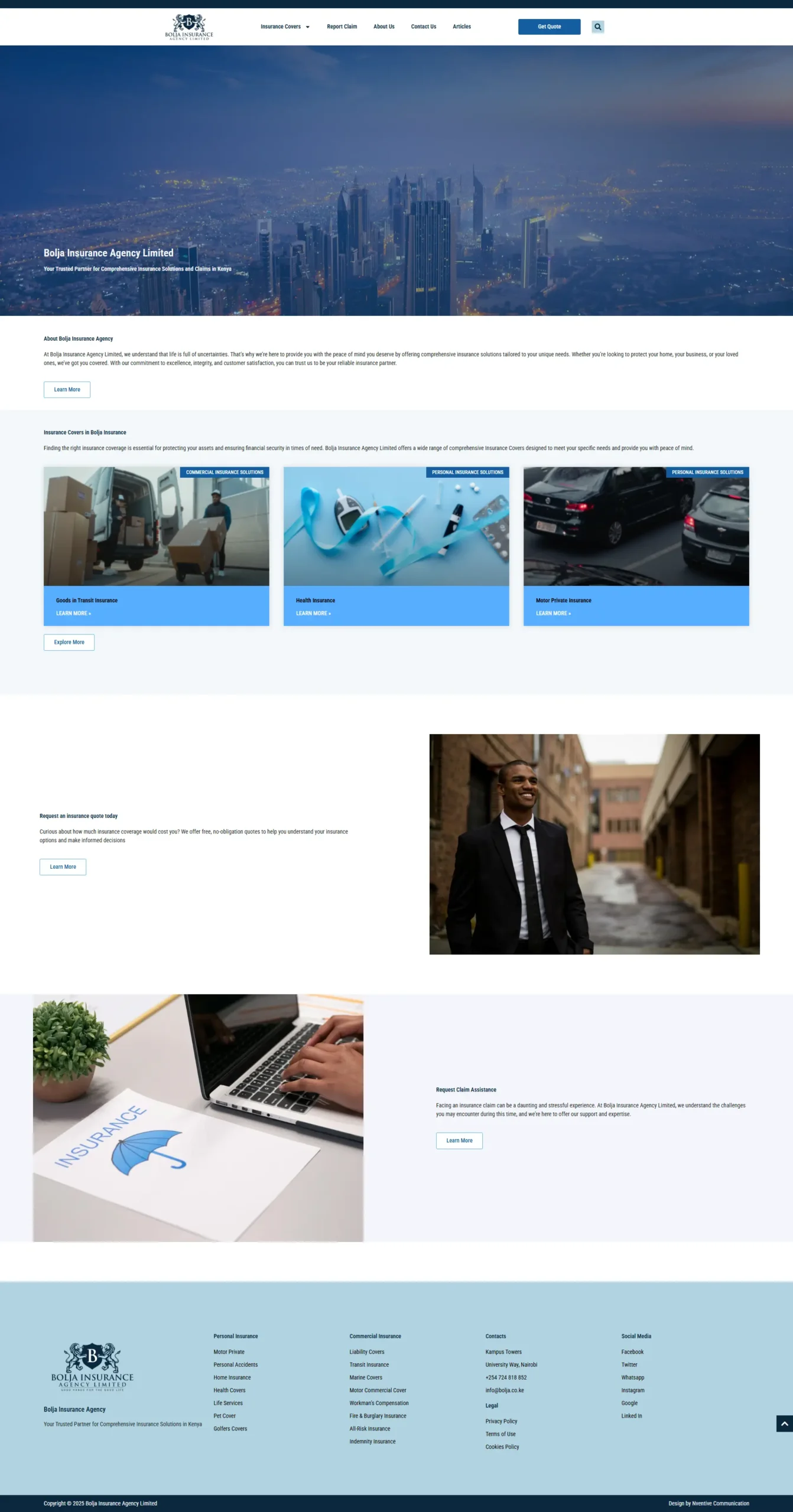

- Design and Branding: A new, user-centric website was designed, focusing on a clean, professional look that aligns with Bolja Insurance’s branding. The site emphasizes trust, security, and ease of use.

-

- Functionality & User Experience: Enhanced navigation with intuitive menus, clear call-to-action buttons for quotes and consultations, and an interactive policy management system for existing clients.

-

- SEO & Accessibility: Implemented SEO best practices to improve search engine visibility, focusing on keywords like “insurance in [location]”, “auto insurance”, and “home insurance”. Also ensured compliance with accessibility standards (WCAG) for broader user access.

Digital Marketing Assets:

-

- Content Marketing: Developed an educational blog section to provide insights on insurance products, changes in laws, and safety tips, establishing Bolja as a thought leader.

-

- Social Media Profiles: Enhanced social media presence with regular updates, customer testimonials, and interactive posts to increase engagement and visibility.

-

- Email Campaigns: Set up an email marketing strategy for lead nurturing, with personalized content based on user behavior and interests.

Digital Tool Integration:

-

- Quote Tool: Integrated a dynamic quote calculator allowing potential clients to get immediate insurance quotes based on their inputs.

-

- CRM System: Connected the website with a CRM to manage leads, client interactions, and follow-ups efficiently.

-

-

-

- Analytics: Utilized Google Analytics and other tools for tracking user behavior, site performance, and marketing campaign effectiveness.

Key Performance Indicators (KPIs):

-

- Website Traffic: Increased by 50% post-launch, with significant growth in organic search traffic.

-

- User Engagement: Time on site increased by 35%, with lower bounce rates indicating better content relevance and user experience.

-

- Lead Generation: Online quote requests and contact form submissions up by 40%, suggesting effective conversion strategies.

-

- Social Media Engagement: Engagement rates on posts increased by 25%, with a notable rise in followers.

-

- Brand Awareness: Local SEO efforts resulted in better visibility in local searches, enhancing brand recognition.

Challenges:

-

- Data Privacy and Security: Ensuring compliance with insurance industry regulations regarding data protection was paramount.

-

- User Education: Many potential clients were not familiar with online insurance purchasing, necessitating clear guidance and trust-building content.

Solutions Implemented:

-

- Secure Data Handling: Employed SSL certificates and worked closely with IT security specialists to safeguard user data.

-

- Educational Content: Created comprehensive guides and videos explaining the insurance buying process, policy details, and how to use online tools.

Recommendations for Future Development:

-

- Mobile Optimization: Continuously refine the mobile experience as a significant amount of traffic comes from mobile devices.

-

- AI Chatbot: Introduce an AI-driven chatbot for 24/7 customer support, enhancing user experience and lead capture.

-

- Advanced Analytics: Use predictive analytics to tailor marketing strategies and personalize user experiences further.

-

- Local SEO: Strengthen local SEO efforts with more location-specific content and community involvement.

Conclusion:

The digital asset development for Bolja Insurance Agency has positioned it as a forward-thinking, accessible insurance provider. The new digital infrastructure has not only improved operational efficiency but also client interaction and market presence.

Next Steps:

-

- Regular digital audits to keep the strategy dynamic and responsive to market changes.

-

- Explore partnerships with digital platforms for broader reach and additional lead generation channels.

Contact Information:

For any questions or to delve deeper into Bolja Insurance Agency’s digital strategy, please contact us

https://bolja.co.ke